Take Your Profit First

With your new, viable business in hand, let's talk about one very important principle that leads to success in your business:

Build a profitable business from the start.

Creators, generally speaking, aren't building businesses with the intent to scale like a rocketship, have an exit, or build a unicorn.

Those ideas are plentiful in the world of venture-backed startups, but our goal in this book is to build a resilient, profitable business that supports your creative work for as long as you want it to.

Perhaps someday you will consider selling your business, but that's not the norm.

Your business is you. It's your work. So we're here to focus on how to make it, as mentioned, resilient and profitable.

Resilient meaning that it is built on a sound foundation and framework, and profitable meaning that it generates a profit with each sale of a product or service.

We discussed part of that in the last chapter on building a viable business. Now we need to take it one step further and begin to look at how you use the money that your business makes.

What happens with the money your business makes

When you make a sale or a client pays an invoice, money enters your bank account.

Let's say you just made $1,000.

What should you do with that money?

You have a few options:

- spend it

- save it

- invest it

In order for your business to function, you have some basic operating expenses, things like rent, internet, software subscriptions, and the tools you need to create your work or provide your service - a computer, phone, tablet, camera, art supplies, musical instruments, etc.

If you don't set aside some money for those expenses, your business won't function properly and you'll find yourself going into debt or not having the tools you need.

You also need to pay yourself, so a percentage of that $1,000 should be set aside for that purpose as well.

You've got taxes that will need to be paid in the future, so set aside some money for that.

And once that's all done, whatever is left is considered profit!

Right?

Well, that's how most businesses think about money.

Profit is often defined as "whatever is left after expenses", and expressed like this:

revenue - expenses = profit

The problem is that it's easy to let expenses grow to the point that they eat up all of the money so that there isn't any profit left!

The problem with not having any profit is that your business isn't able to grow. There's no money to invest in new opportunities, new tools, or new projects, so the business reaches a certain level of revenue and expenses and stays there for years and years and years.

The only reason I was able to start Craftsman Creative - at the start of the pandemic and after being furloughed from the TV show I was producing, mind you - is that I had been setting aside a percentage of my business income in a separate profit account for over two years.

That money had accrued to thousands of dollars that I was able to use to pay my bills but also invest in building a new business.

Without that profit, this business wouldn't exist, and I may have had a hard time providing for my family and my lifestyle throughout the uncertainty of the last year.

Here's what you need to do: take your profit first.

How To Take Profit First

Mike Michalowicz wrote a book called Profit First years ago that completely shifted the way I think about money in my businesses, and led to that business-saving profit account.

In it, he helps business owners think about profit in a different way, by changing the order of how money that comes into the business is used.

Instead of revenue - expenses = profit, it becomes:

revenue - PROFIT = expenses

This slight shift makes a world of difference. It guarantees that money is set aside to grow and invest in the business and provides quarterly distributions (think "bonuses") to the business owner.

With my quarterly distributions, I've bought a watch, AirPods, a new phone, and plenty of other things that I wouldn't have thought of with my old mindset because I would have spent that money elsewhere in the business.

Remember, expenses will eat up as much money as you feed it, which is why you need to set aside profit first.

Here's how to do it:

Start with 1% of your revenue. For every $100 that comes into your business, set aside $1 and put it into a profit account that is separate from your main business expense account.

(Many banks will allow you to open multiple accounts under one login, and I'd recommend that you do this for your business as well. Mike goes into lots of detail in his book on how to set this up.)

Then, every quarter, add 1%, so that a year from now you're saving 4-5% of your revenue, and closer to 8-10% in two years.

That means that if your business makes $100,000, you're setting aside $10,000 to have money in the bank in case times get tough (resilience), and to pay out money to you as the business owner for building a profitable business.

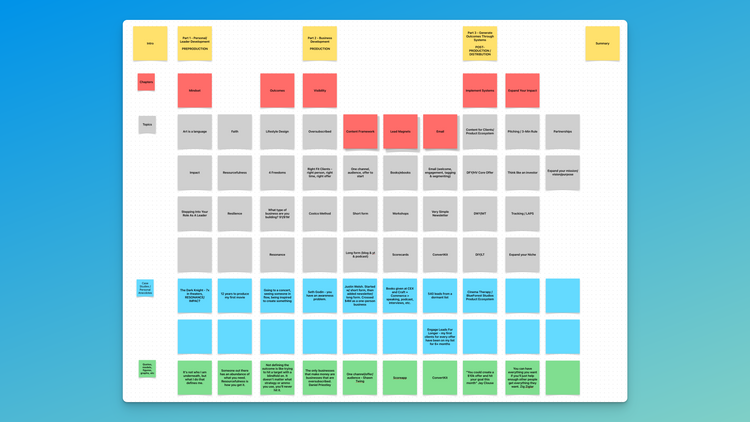

Mike recommends that you do a "profit first session" twice a month, where you add up all of the revenue you made in the previous 15 or 16 days, then distribute that money out to the different areas of your business.

A typical budget for a creative small business may look something like this:

- Profit: 5%

- Owner's Pay: 60%

- Taxes: 15%

- Operating Expenses: 20%

Putting operating expenses last in the bi-monthly payout means that you have a set amount that you can spend on expenses, rather than having your expenses eat up all of the money and leave nothing left for profit, not enough for you to live on, and nothing for taxes, which can be a mess come tax season.

That's a good budget to work toward, but going from 0% profit margin - because you've never considered it before - to 5% instantly is a huge jump.

Start with 1% for the next 1-3 months. It will get you into the habit of regularly (twice a month) setting money aside.

Then at the start of the next quarter (generally January, April, July, and October) bump that profit percentage up by 1%.

You can do more if you feel comfortable, but this is a good pace to get to that 5% profit budget in the next year or so.

I highly recommend that you check out the book Profit First if you want to go into more detail, as it lays out everything you can do with this process and the incredible benefits of having profit for your business.

NEXT CHAPTER >

< PREVIOUS CHAPTER

Member discussion